Turbocharging AML Investigations with Decision Intelligence

An estimated 2 to 5% of global GDP, or roughly €715 billion to 1.87 trillion, is laundered each year, according to the United Nations Office on Drugs and Crime (UNODC). Money laundering is growing in scope and scale worldwide, as bad actors use increasingly complex tactics to carry out illicit financial schemes. New technologies and techniques allow criminal organizations and terror groups to keep ahead of financial intelligence units (FIUs) and other government authorities responsible for combatting money laundering.

Unfortunately, authorities often rely on outdated tools which are optimized for AML compliance, rather than for money laundering and terror financing investigations. Read on to find out how decision intelligence solutions can transform and accelerate the work of anti-money laundering investigators.

The growing scale of money laundering and terrorist funding

Despite intensive efforts by financial intelligence units and law enforcement authorities, these organizations succeed in stopping only an extremely small share of money laundering and terrorist funding activities. In the Netherlands, for example, the national FIU, police and prosecutor’s offices are flooded by a million suspected money laundering cases every year, far exceeding their capacity to investigate and prosecute perpetrators. In 2021, the Dutch FIU, was notified of €15.4 billion worth of possible money laundering transactions. Of this enormous amount, the FIU was able to seize only €386 million, constituting a mere 2.5% share of the money suspected of being laundered.

Authorities face numerous challenges in fighting money laundering, including difficulties in achieving effective cross-border cooperation between government authorities, as well as constantly evolving tactics being used by money launderers and terrorist funding networks. As bad actors continue to evolve and adopt methods such as money mule schemes, multi-customer cross-wallet activity and the use of crypto exchanges, many FIUs are struggling to keep up.

Top challenges in AML and CFT investigations

The main data-related challenges in the AML investigation process are the complexity of extracting insights from massive amounts of siloed data, insufficient time to investigate leads, and a high false positive rate for suspicious transactions. To successfully resolve investigations, FIUs must overcome these challenges and streamline decisions about which Suspicious Transaction Reports (STRs) and Suspicious Activity Reports (SARs) to focus on, which individuals and companies require extra scrutiny, and how to allocate investigation resources.

The traditional compliance-focused approach to AML and terror financing is insufficient. The FIUs responsible for uncovering money laundering networks are swamped with an overwhelming amount of compliance information from financial institutions. For example, the Canadian FIU FINTRAC receives almost 180,000 STRs, over 10 million large cash transaction reports and over 14 million electronic funds transfer reports per year. These compliance reports are generated using traditional, rule-based tools, which generate a shockingly high 90-95% rate of false positive suspicious transaction alerts, according to recent research. This vast amount of (often inaccurate) data makes it extremely difficult for FIUs to sort through the noise and decide where to focus their resources and attention.

How decision intelligence accelerates anti money laundering investigations

Decision intelligence is the practical application of analytics, machine learning and AI technologies to augment and improve human decision making. Applying a decision intelligence approach to the money laundering investigation process allows investigators to more effectively uncover money laundering networks and the financial entities enabling them. Rather than looking at one transaction surfaced by a business rule, investigators can look at a full sequence of events, extracted from multiple data sources, within a chronological, geographical, and situational context.

Decision intelligence platforms leverage technologies such as data fusion, machine learning and AI, in addition to collaboration and data visualization tools. These platforms enable organizations to automatically fuse, enrich and analyze data from virtually any source, on a massive scale, in order to provide a holistic view of all relevant data, extract hidden insights and generate data-driven decisions. This allows investigative teams to focus on the highest priority transactions, assess risks more accurately and resolve cases faster.

The benefits of NEXYTE for AML investigations

NEXYTE, Cognyte’s decision intelligence platform, is designed to accelerate decision making and boost AML and CFT investigations through multi-source data fusion and machine learning analytics. NEXYTE enables authorities to unify financial investigations into a single workspace and augment their risk assessment, leading to faster case resolution and increased recovery of illicit funds. Tailored AML analytics allow investigators to draw actionable insights from all relevant data sources.

NEXYTE offers key capabilities that enable AML investigators to surmount both the data and decision-making challenges they face.

- Data fusion enables fusing virtually all available data sources, no matter the format or type, into a single, unified view, allowing investigators to gain a deep understanding of individuals and entities involved in financial activities. SAR/STRs, bank records, news reports, sanctions lists, invoices are just a few examples of potentially valuable data sources that investigators can fuse and analyze using NEXYTE. With NEXYTE’s Dynamic Data Modeling Studio, organizations can tailor the platform to best fit their specific data sources and investigative methodologies, with virtually no coding or technical expertise required.

- Visual link analysis allows investigators to map links between entities, enabling them to follow the money trail by visualizing money flows and to simplify the identification of beneficiary owners. Visual link analysis is a powerful capability that enables investigators to more effectively validate their analysis and map out money laundering operations and enabler networks.

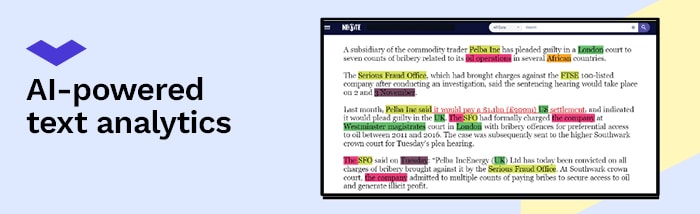

- AI-powered content enrichment tools, such as textual, image, video and audio analytics, help investigators to reveal and gather information from potentially valuable unstructured sources, such as adverse news reports and social media. Data from unstructured sources helps to enrich entity profiles and augments risk scoring.

- Automated risk scoring assigns ascore to all financial entities and events in NEXYTE’s investigative workspace, based on machine learning models as well as risk factors defined by the FIU or government authority. With automated risk scoring, investigators can home in on individuals, transactions and activities that are most likely to be related to money laundering or terror-funding schemes.

Best-in-class decision intelligence platforms like NEXYTE equip investigators with the AML intelligence they need to resolve cases faster and to combat financial crime more successfully.

Check out our new ebook to learn more about how NEXYTE accelerates AML investigations in 7 steps.