Fighting Organized Crime with Data Analytics

During my tenure as the Assistant Director of Tax and Financial Investigations at the Mexican Tax Attorney’s Federal Office, I saw the growth of organized crime firsthand.

We often think of serious or drug-related crimes when we think of organized crime, but money laundering and corruption are the financial engines that fuel organized groups, cartels, and gangs. Money laundering allows organized crime ringleaders to enjoy the profits of their crimes, while bribes and other tactics enable them to continue operations while corrupt officials turn a blind eye.

Organized crime is a growing problem for governments around the world, with a recent article from INTERPOL stating that organized crime is growing at an unprecedented rate, particularly with a concern of increasing transnational crimes.

Although these networks are notoriously difficult to take down, well-known cases of arrests based on financial infractions show what an important role financial investigation units (FIUs) have in fighting organized crime syndicates, gangs, and cartels. One of the most notorious examples of this tactic was Al Capone, an American mob boss who was finally convicted on tax evasion charges.

Recent cases include the 2021 arrest of 21 members of the Sinaloa Cartel and Jalisco New Generation Cartels of Mexico, who were charged by US officials with money laundering associated with their cross-border drug trafficking operations. In connection with the case, a special agent from US Homeland Security Investigations said, “The key to dismantling Drug Trafficking Operations is disrupting the flow of illicit funds and attacking the money laundering element of the organizations.”

Successful financial investigations are critical to deterring serious and violent crimes perpetrated by organized crime networks. Technology is fueling more sophisticated tactics for criminals to perpetuate both domestic and cross-border financial crimes. It is thus essential for law enforcement agencies to adopt new technologies to combat these crimes.

This is a topic about which I know intimately. During my time working in law enforcement, I came to learn the best methodologies and tools investigators need to conduct modern investigations.

Law enforcement agencies, including financial crime units, are bogged down with masses of data, case backlogs, and siloed data sources. The use of machine learning and AI has become essential for case triage, compliance, and investigations. Read on to find out how.

Using risk scoring to triage financial crime investigations

Criminals rarely stick to one crime, especially when we are discussing organized crime. Financial crime units must decide how to investigate and prosecute complex cases for the best results. The same criminal or organization may have committed many kinds of financial crimes, and authorities need to think strategically.

Resources are scarce, and investigators have different specialties, so agencies must decide which cases will have the best shot at being solved, have the highest impact on deterrence, and result in the largest fund seizure. This is where risk scoring comes in.

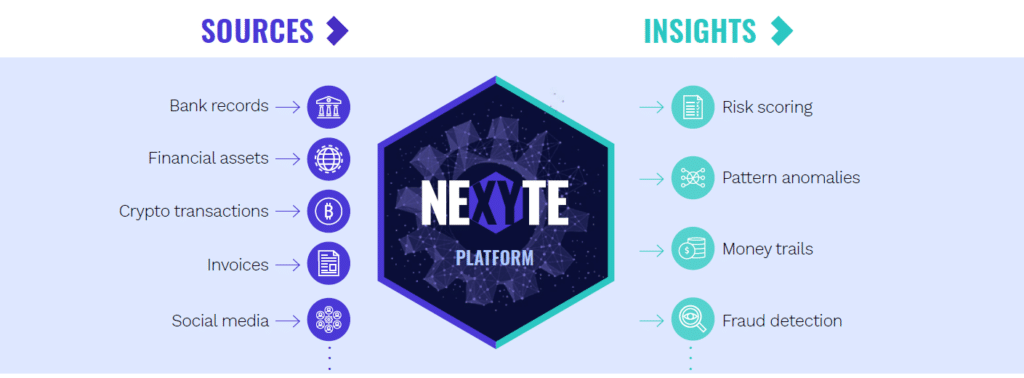

Automated risk scoring capabilities, provided by machine learning (ML) and AI platforms, can parse through data to prioritize cases based on the involvement of known criminals, previous investigations, and other parameters. Advanced platforms allow law enforcement investigators to analyze all available data related to an entity (such as an individual, company, or bank account). This data can be derived from siloed sources, such as police databases, OSINT, communications records obtained under warrant, and more, and contributes to a holistic risk score that allows investigators to utilize resources effectively.

Risk scoring can be based on:

- Business rules that allow investigators to predefine the attributes or conditions that determine whether a suspect will be judged high risk and the weight each condition has on the risk assessment.

- ML models that incorporate predefined risk factors that are relevant to specific use cases and environments.

- ML models that extract features/attributes from the data without input from the investigator. This will surface new attributes that can be weighed into a risk assessment. An investigator can define an initial set of defined criteria based on their knowledge and expertise. The ML model then analyzes the data sets and extracts parameters to recommend risk factors for data scientists to use to build and train a more effective risk-scoring model.

The right tools ensure compliance in organized crime investigations

Once financial investigations are underway, it is essential that law enforcement agencies uphold strict compliance with international, federal, and local regulations, such as those related to warrants, evidence gathering, data privacy, and bank secrecy. In my experience, advanced tools help to ensure that investigators stay in compliance so that missteps do not compromise cases.

A good tool must have:

- Fine-grained permission models based on investigation, data source type, sensitivity, and function. This ensures fully granular access control and avoids data leaks.

- Detailed reporting to preserve the chain of custody, including a source indication for each data point (monitoring center, interrogations, etc.).

- Comprehensive audit trail features to track and log all user actions in the system as a method of preventing misuse.

Taking financial investigations to the next level with decision intelligence

Once investigators know which cases to investigate, and how, they need to do the heavy lifting of investigations. Financial investigations can be very difficult cases to close because they often involve many entities and a long timeframe. Below are some essential capabilities for financial investigations:

- Data fusion: Investigators need cohesive entity and event profiles from disparate sources, like government databases, account information, tax records, and more. Correlating documents, images, videos, and other data ensures that FIUs don’t miss critical information in their cases.

- Risk scoring: Risk scoring is helpful for prioritizing which transactions, activities, or financial entities are the most suspicious and should be investigated further. One example of this might be if several known money laundering networks register shell companies in the same offshore tax haven. Another example might be certain characteristics of individuals who registered companies, such as having a criminal record.

- Data visualization: Timeline analysis is essential for financial crimes, such as money laundering, which often stretch over months or years and involve many transactions. Timeline widgets are a valuable visual aid in surfacing suspicious behavior and revealing patterns. Another essential data visualization tool is a link graph, which maps connections between investigation subjects, and may show paths between known criminals to seemingly legitimate businesses or relations.

- Automatic alerts: Alerts are key for time-critical case developments and can be set to trigger if certain conditions are met, for example, if laundered money has been transferred into a suspect’s bank account or his relative’s account.

NEXYTE, Cognyte’s decision intelligence platform

As I look back on my career in financial investigations, I often think of ways that NEXYTE, Cognyte’s decision intelligence platform, would have been incredibly helpful in solving cases faster. In my role at Cognyte working directly with law enforcement organizations, I am constantly seeing new benefits that decision intelligence technology brings to investigators, and I am excited to share the insights I have developed from both my career in law enforcement and at Cognyte. To learn more, contact us.