5 Ways to Accelerate Tax Investigations with AI and Decision Intelligence

Tax Fraud is Winning the Race

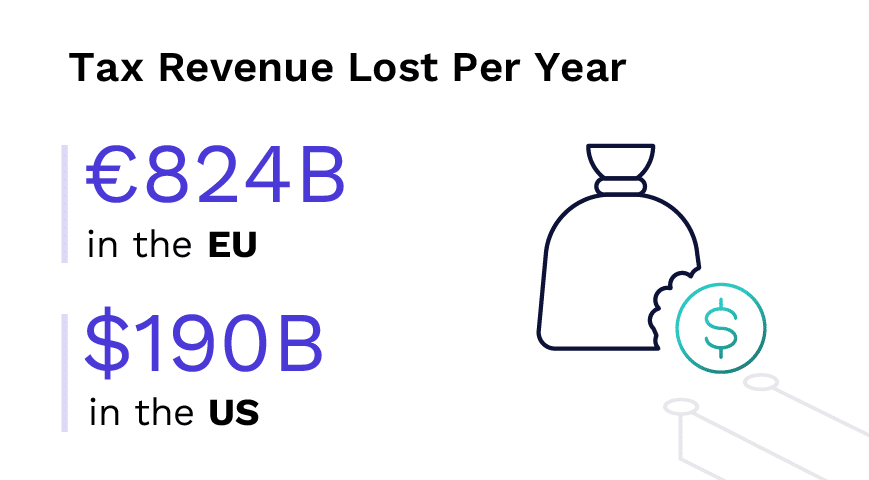

Tax fraud is a growing problem, with ever more sophisticated tactics employed by perpetrators. Traditional analytics tools and BI solutions are struggling to keep up, leaving tax authorities grappling with the staggering costs of tax evasion and fraud. In the EU, it amounts to a mind-boggling €824 billion annually, while the US loses nearly $190 billion each year due to underreporting and underpayment of taxes.1 To combat this escalating issue, tax authorities need a game-changing approach.

That’s where decision intelligence platforms come into play.

The Benefits of Decision Intelligence for Tax Authorities

Decision intelligence platforms utilize data fusion, machine learning, AI capabilities and analytics tools to automatically analyze massive amounts of data from virtually any source. The result? Actionable insights that help tax authorities uncover fraudulent activities and identify potential tax evaders. Let’s explore the five key capabilities of decision intelligence that can accelerate tax investigations.

1. Holistic Entities

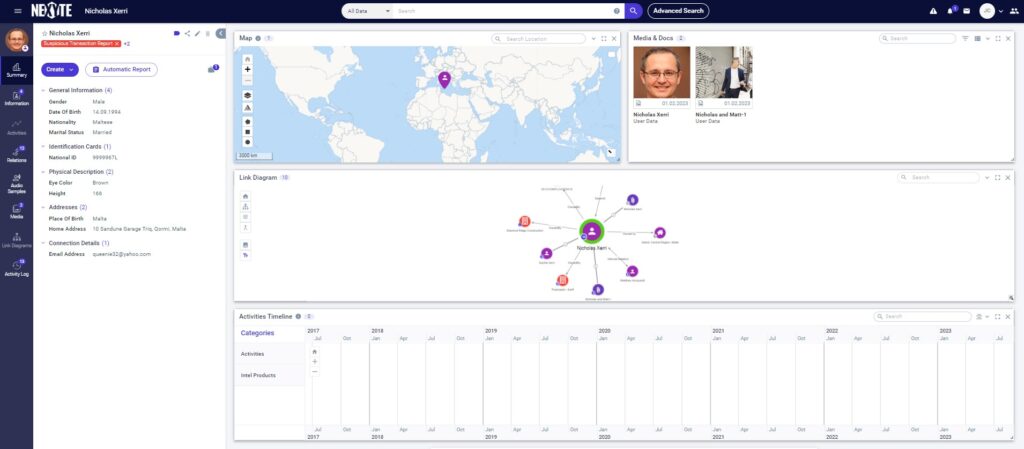

Best-in-class decision intelligence platforms seamlessly fuse data from different sources to create unified entities, such as individuals, companies, financial accounts, real estate assets and more. The entity dashboard displays all information related to an entity (such as tax documents, property records, invoices, images, and videos) and presents the data in widgets (link analysis diagrams, activity timelines, geo-spatial maps, etc.).

By visualizing data in this way, tax investigators can quickly spot discrepancies and suspicious activities, accelerating their investigative process.

Holistic entity dashboard

2. AI Enrichment

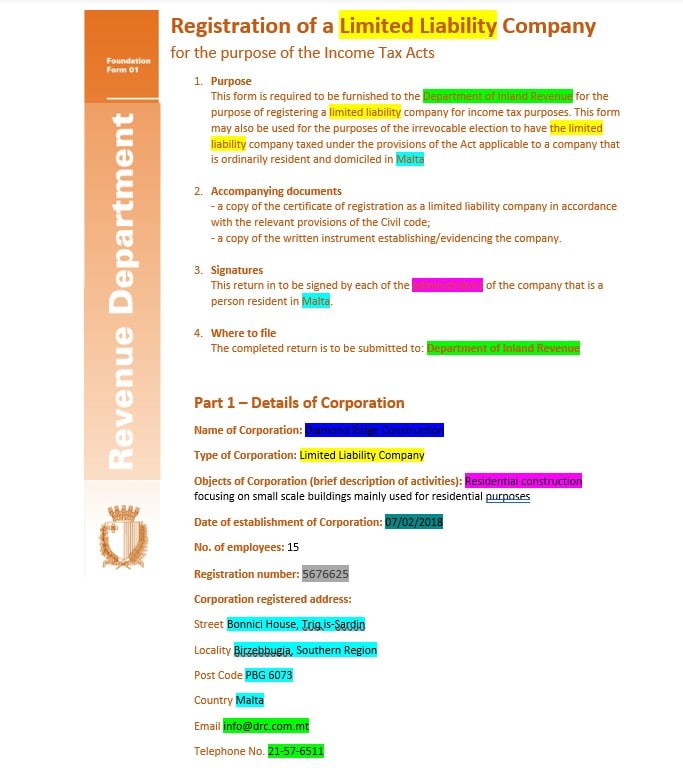

AI-powered content enrichment tools enable investigators to extract valuable information from unstructured sources such as scanned documents, images, and videos. For instance, speech-to-text transcription of video files, coupled with text analytics applied to the transcripts, can reveal hidden connections and shed light on the methods employed by suspected perpetrators of tax fraud.

With AI enrichments, investigators can deepen their understanding of individuals, companies, and their activities, giving tax authorities an edge in uncovering complex tax fraud schemes.

AI-powered text analytics

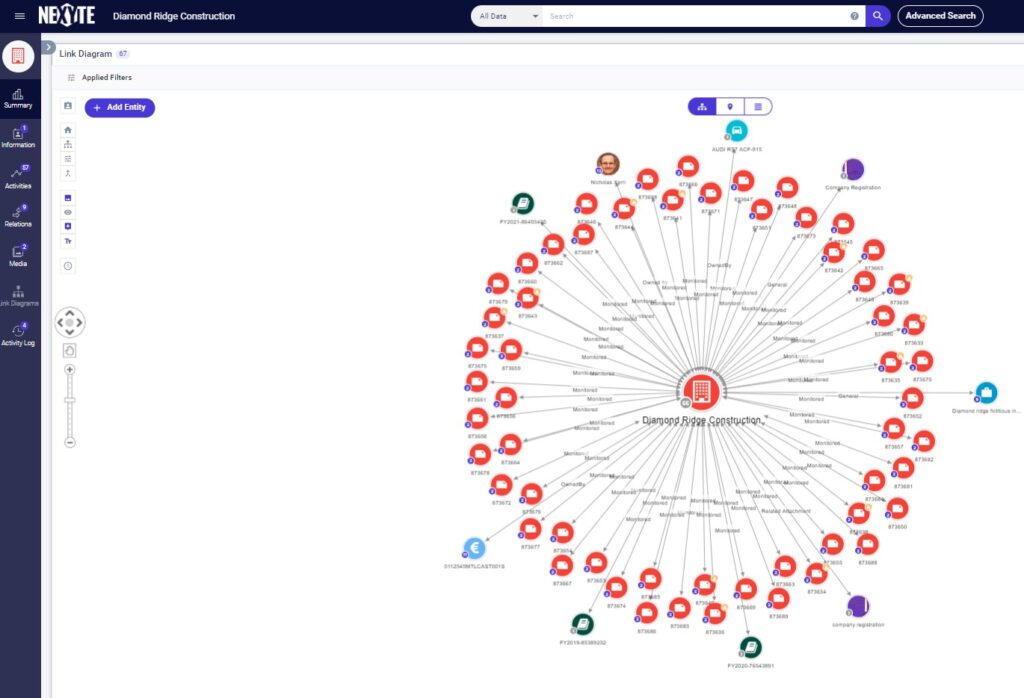

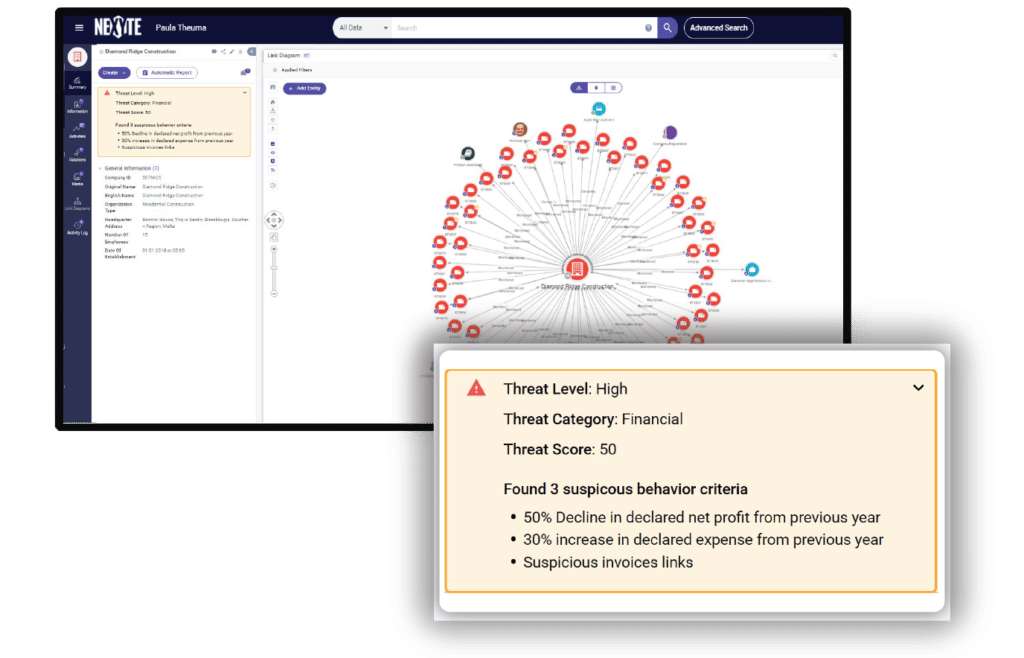

3. Link Analysis and Timeline Analysis Link analysis is a powerful capability that allows investigators to visually map connections between entities such as individuals, companies, tax declarations, financial accounts, and transactions. It helps trace complex relationships involving multiple intermediaries, such as shell companies and individuals, which are used to obscure the ultimate beneficiaries. Link analysis assists in detecting sophisticated evasion schemes that are hard to detect with manual methods or conventional tools.

Link analysis widget

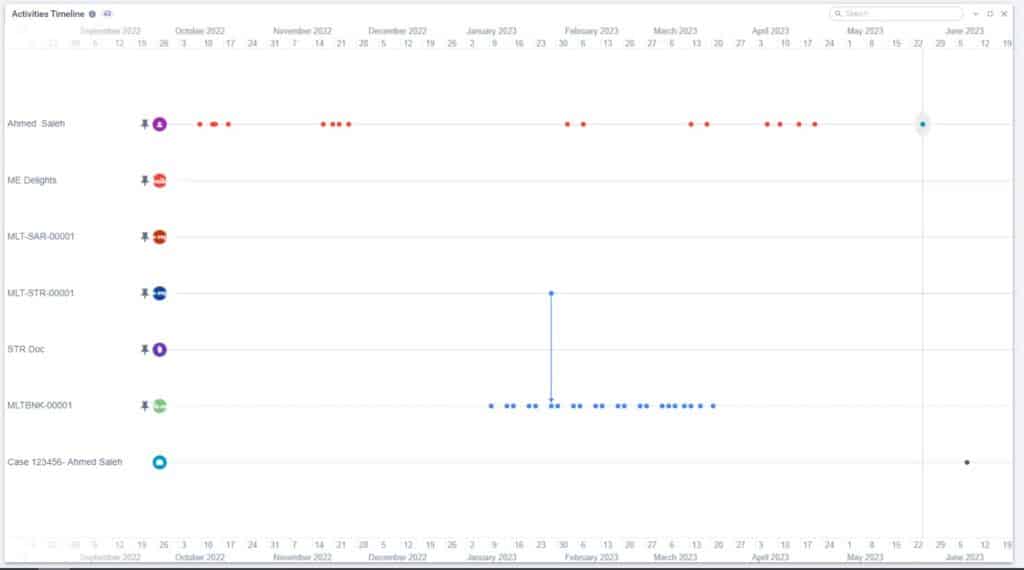

Using timeline analysis, the system organizes relevant activity (financial transactions, tax declarations, travel records, etc.) on a unified timeline, to help investigators detect suspicious patterns and trends.

Timeline widget

4. Risk Scoring

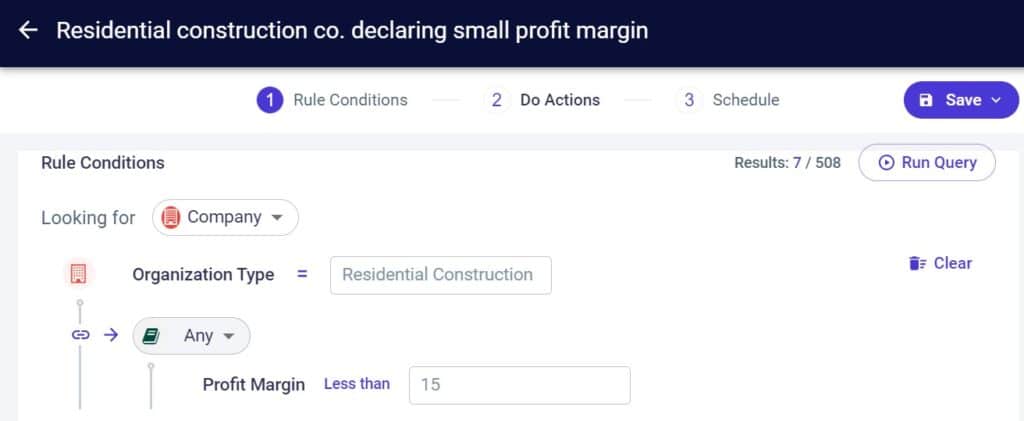

Risk scoring combines user-defined business rules with tailored machine learning algorithms trained on historical tax evasion and fraud cases. By analyzing data connected to potential audit candidates, such as company assets, reported income, and past invoice data, the system generates a risk score, which helps authorities prioritize which cases to investigate and how to allocate resources effectively.

The combination of human expertise with machine learning algorithms allows tax authorities to automatically calculate risk scores tailored to their specific criteria and needs.

Business rule creation

Risk score example

5. Collaborative Investigation Workspace

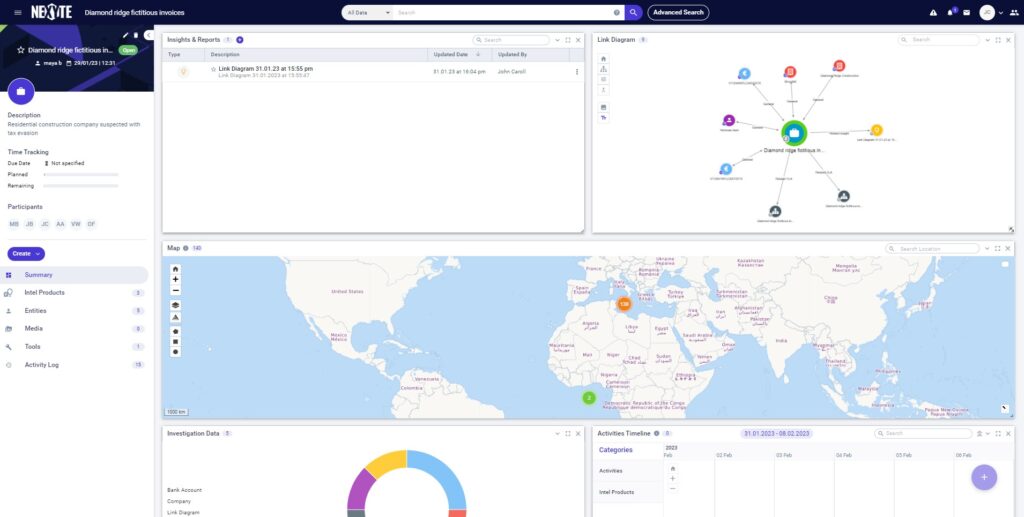

The power of teamwork and collaboration cannot be underestimated in tax investigations. Decision intelligence platforms provide a collaborative investigative workspace that consolidates all data and insights related to a tax investigation in a single, user-friendly view. Analysts can easily access data involved in the case, related intelligence insights, and data visualizations—all in one place.

The investigative workspace enables seamless collaboration across teams and organizations, streamlines information sharing and accelerates insights.

Collaborative investigation workspace

The Future of Tax Investigations is Here

Decision intelligence is revolutionizing tax fraud investigations by empowering tax authorities to make quick, data-driven decisions with the help of unique tools and insights. Platforms like NEXYTE, Cognyte’s decision intelligence platform, are leading the way in boosting the accuracy and effectiveness of investigations. By leveraging AI and decision intelligence, tax authorities can resolve cases faster and increase revenue collection. The future of tax fraud investigations is here, and it’s driven by the power of decision intelligence.

Click here to learn how NEXYTE can accelerate your tax investigations.

Sources: