Preventing Customs Fraud with Decision Intelligence

On a typical day in the United States, customs officials process over $7.6 billion in imported goods, primarily from almost 90,000 containers that arrive over land, air, and sea. They seize almost 5,000 pounds of illegal drugs, $340,000 worth of illicit currency, and $9 million worth of counterfeit goods. In addition, over 900,000 people enter into the US.

The scale of operations is massive, not only in the U.S., but in countries across the globe. Despite the many successes that customs officials achieve in their enforcement actions, according to United Nations Conference on Trade and Development nearly $2 trillion is lost to the global economy annually due to customs fraud, smuggling, incorrect valuation of goods and incorrect calculation of Harmonized System codes.

Customs officials are under pressure to move goods in and out faster, yet at the same time to enforce compliance of customs tariffs and prevent illegal trade. With bad actors using multi-national schemes and increasingly sophisticated technology to evade detection, customs officials are caught in a difficult position. More smuggled goods are likely to slip past customs, and more customs violators are likely to avoid paying their full customs duties on legitimate cargo.

However, if customs officials were able to predict more accurately which shipments should be inspected, they could clear more goods faster while preventing customs fraud and smuggling.

Tackling the data overload and extracting insights from it

The challenge facing customs officials isn’t new or unique. Banking and ecommerce are just two industries tasked with processing hundreds of millions of daily transactions. Those industries have turned to analytics and artificial intelligence tools to help prevent money laundering, fraud and cyberattacks.

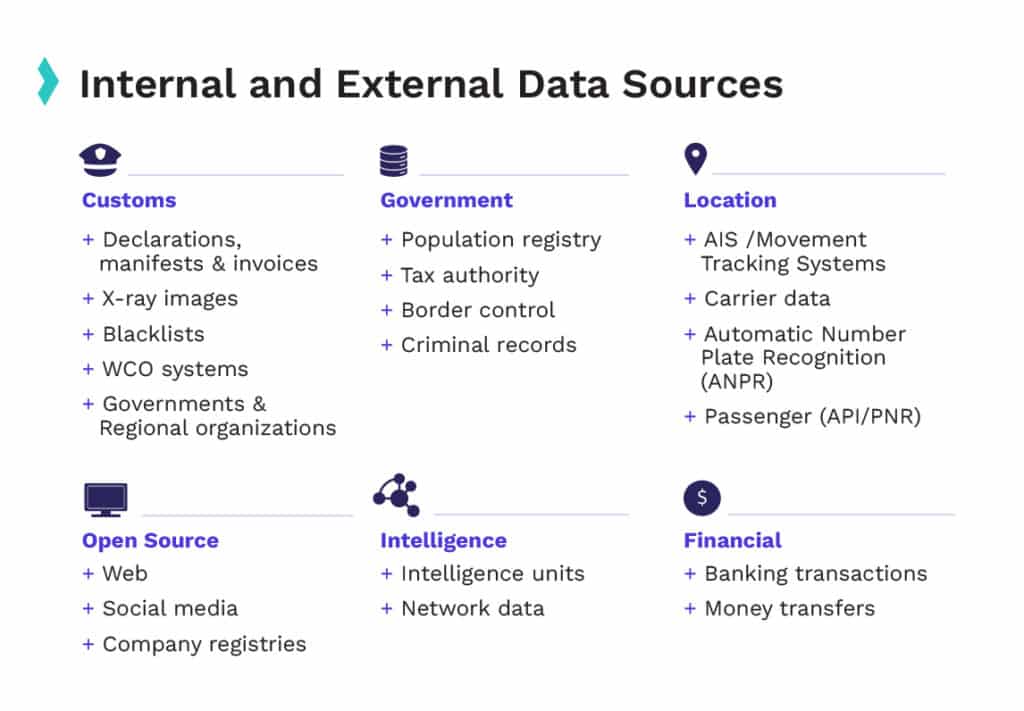

As we explored in Cognyte’s recent report, customs agencies are also increasingly leveraging analytics to target their enforcement more precisely and help them process more goods faster. There are many private and public data sources that can be used for these efforts. In fact, customs agencies are flooded with an overload of data. The challenge is extracting actionable, timely insights from that data, rather than drowning in it.

Data from customs declarations, x-ray images, and other internal sources can be combined with external data like tax records, criminal records, AIS tracking systems, and passenger data to achieve a big picture view and leverage powerful machine learning models to generate insights that would be almost impossible to obtain manually. These models can, for example, guide customs inspectors to fast-track certain containers while examining suspicious shipments more closely and can help analysts to uncover and investigate patterns of suspicious activities and customs fraud.

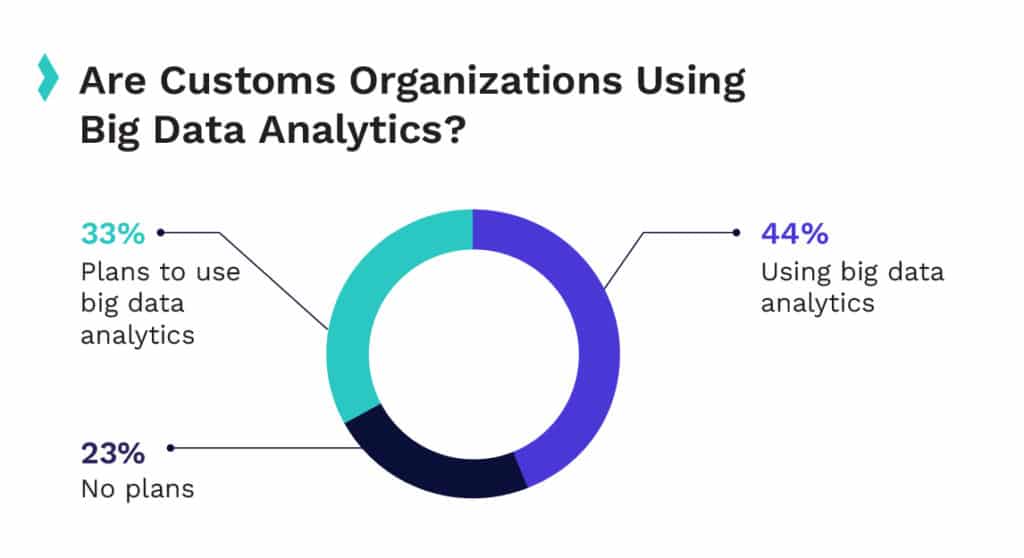

According to the 2021 WCO annual survey, an impressive 44% of customs authorities report that they are using big data analytics in some capacity today, while another 33% intend to in the near future. To date, however, customs organizations have underutilized the data they have access to. The data sources are often siloed, and it has been difficult for customs organizations to deploy analytical solutions that can combine structured and unstructured data to present a holistic view. A recent Cognyte survey found that 78% of customs agencies felt fusing together large volumes of data was their biggest challenge when it came to extracting actionable insights from data. As a result, even those customs officials who are using big data analytics today may only be getting a partial picture, at best.

The Benefits of Decision Intelligence to Customs Organizations

Decision intelligence takes analytics to the next level. It is the application of analytics, machine learning, and AI to support and enhance human decision making, and has the potential to automate the decision-making process.

Decision intelligence was designed for an era of information overload. It takes disparate, siloed repositories of structured and unstructured data and seamlessly fuses them together into a unified view. It generates actionable insights for faster, more accurate decision making.

As covered in Cognyte’s recent report, authorities can use decision intelligence to conduct smarter customs investigations and risk management in order to improve their fraud detection, conduct more targeted enforcement and increase revenue collection.

There are four primary use cases for decision intelligence within the customs domain.

- Fraud Detection – Customs officials can more easily detect customs fraud through automated analysis of customs declarations, invoices, and manifests. A decision intelligence platform can even compare the documentation submitted with pricing information scraped from ecommerce sites to determine if the declared value has been over- or under-declared.

- Risk Management – Using passenger manifests, ship movement data, and other data sources, decision intelligence can greatly improve risk assessment and help identify which shipments and passengers should be detained for inspection, and which can be rewarded with faster approvals and clearances.

- Investigations and Intelligence Analysis – decision intelligence platforms can help find anomalies that indicate suspicious patterns of trafficking and smuggling. They can also reveal links between shipments and previous violations, and more accurately predict which shipping companies are likely to falsify tax documentation.

- Workforce Planning – decision intelligence platforms can help customs organizations improve operational efficiency by allocating staff based on predicted trends.

Combating Customs Fraud and Optimizing Customs Operations with NEXYTE

NEXYTE, Cognyte’s Decision Intelligence Platform, is designed to enable faster and more accurate decision making through multi-source data fusion and machine learning analytics. Using NEXYTE allows customs organizations to automatically assign a risk score for imports and exports, leading to optimized customs clearance and increased revenue collection. NEXYTE enables more effective investigations and allows authorities to plan their enforcement actions in a more precise, targeted manner in order to reduce illegal trade and customs tax evasion.

NEXYTE provides intuitive data visualization tools, making it easier for investigators to explore the data and understand the findings. It enables analysts and investigators to share information, collaborate effectively, and exchange data with customs officials and law enforcement agents in the field.

Read our report, Transforming Customs Operations with Decision Intelligence, to learn more about how decision intelligence can help your organization increase revenue collection and prevent customs fraud.

Click here to book a live demo of NEXYTE with our experts